Originally Posted in CUToday Quarterly

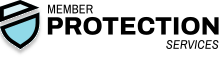

The youngest generation (Generation Alpha) to the oldest living (Silent Generation), and every generation between, have vastly different financial needs and expectations. To reach and connect with your current and future members, and offer the right product for their financial journey, it is important to anticipate what their needs are and will be and have a menu of products to fill those needs.

But who are the different generations? How do their values differ, and does it matter when it comes to selling products and services? Meet each generation, learn what they value, and which products your credit union can offer to meet their financial and lifestyle needs.

Value: Personalized experiences, social and ethical justice, authenticity

Member service preference: Chatbots, texting, social media

Target products for Gen Z:

-

- Digital / electronic payment options

- Cryptocurrency custody

- Buy now, pay later

- Checking, debit, and credit card rewards

- Home & auto insurance

- Short-term loans

- Student loan refinancing

- Unemployment insurance

- Savings accounts for lifestyle choices (i.e. auto purchases, weddings, education)

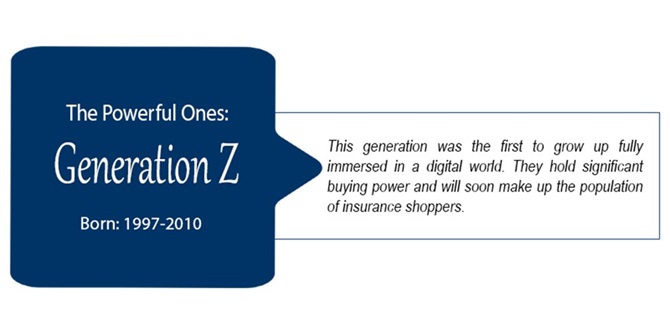

Value: Convenience, flexibility, building wealth

Member service preference: Chatbots, social media, website, text

Target products for Millennials:

-

- Auto deductible reimbursement

- Digital payments

- Checking, debit, and credit card rewards

- Life insurance

- Home protection

- Short-term loans

- Student loan refinance

- Buy now, pay later

- Savings accounts for lifestyle choices (i.e. real estate down payment, travel, education)

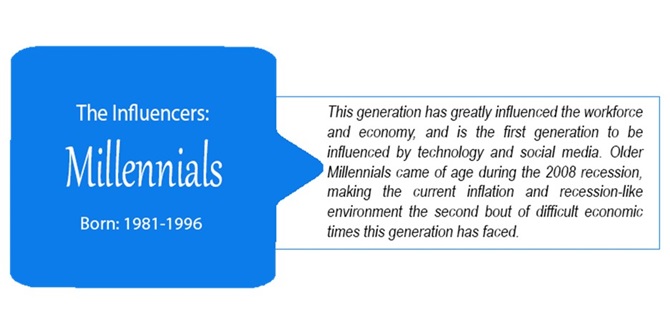

Value: Work ethic, autonomy, flexibility

Member service preference: Over the phone, website

Target products for Gen X:

-

- Auto protection

- Checking, debit, and credit card rewards

- Medical coverage and emergency

- Unemployment insurance

- Savings accounts for lifestyle choices (i.e. extra spending cash, auto and home purchases, home improvements)

- Estate planning

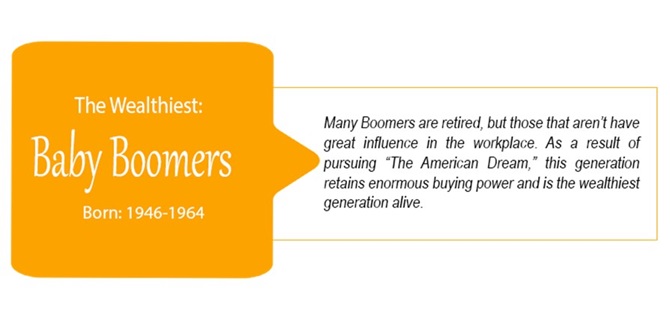

Value: Achievement, relationships, stability

Member service preference: Face-to-face, over the phone, website

Target products for Boomers:

-

- Vehicle protection

- Extra cash and spending

- Estate planning

- Medical coverage

- Disability and critical care insurance

- Savings accounts for lifestyle choices (i.e. travel, home improvements, life events, family needs)

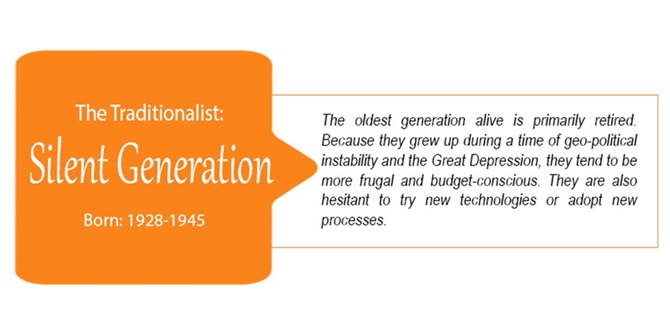

Value: Work ethic, autonomy, flexibility

Member service preference: Over the phone, website

Target products for The Silent Gen:

-

- Auto and home maintenance

- CDs and savings accounts

- Medical coverage; Medicare Supplements

- ID Theft

- Estate planning

Serving Each Generation While Increasing Product Sales

America’s youngest citizens are still being born daily. Credit unions can start preparing to serve this demographic with a savings account for future education.

Credit unions face the challenge of serving members from ages 13 to 75+ who all spend, but have vastly different reasons for why and how they are spending their money.

Core values drive purchasing decisions. Each generations’ values might differ, but across every demographic your members want connection, value, and education. Connecting with each generation will be different, but knowing your members’ season of life, values, and goals will help educate them on which products will bring the most benefit. Staying needs-focused instead of product-focused will help build authentic relationships, laying the foundation for increased product sales down the road.